THE RISK-REWARD PARADIGM

THE RISK-REWARD PARADIGM

In the mergers and acquisition arena, we are more concerned about perceived risk as opposed to actual risk. Risk perception is the subjective judgment a person or organisation makes about the probability of a risk occurring and its potential impact on the individual or organisation, and this will vary depending on the situation, timing, and experience and background of the perceiver.

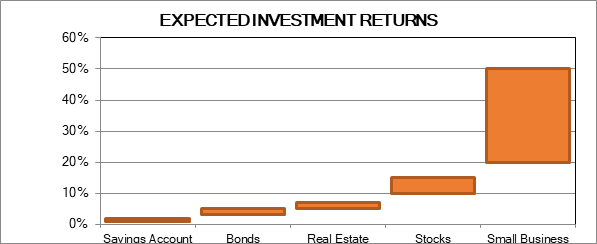

So how do we measure perceived risk? Since perceived risk is subjective, we often frame the answer in terms of a comparative approach to risk. Buyers have choice. They can choose to purchase or not to purchase. They can choose to invest in a variety of

investments opportunities with a variety of risk-reward profiles.

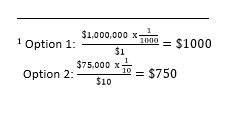

Let’s look at two options:

- You can buy a lottery ticket with a 1 in 1000 chance to win for $1. The jackpot is $1 million dollars.

- You can buy a lottery ticket with a 1 in 10 chance to win for $10. The jackpot is $75,000.

Which option would you pick? Mathematically option 1 would give a reward probability per dollar spent of $1000 while option 2 would result in $750 so mathematically the obvious choice would be option However there is a significantly greater probability that in

option 1 you will get nothing, versus in option 2 there is a 10% probability you would get $75,000. The emotional component may favour option 2 as it has the largest real possibility of getting something. Would your decision change if the cost of a ticket was $50,000, the probability of winning was still 10:1 and the payout probability per dollar spent was still $750? For some people this would change their choice and for others it would not.

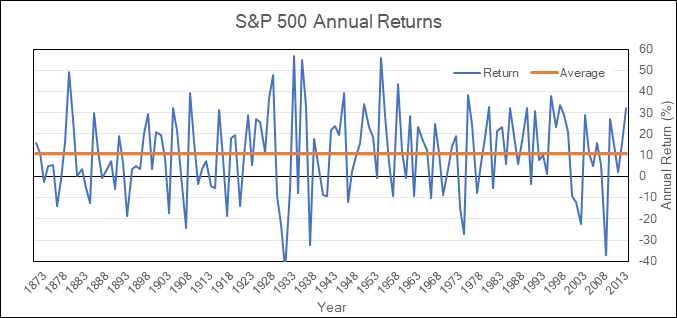

With respect to assigning risk to a small business, we can look at comparable investments which we have a better sense of their risk profile. A savings account has little risk and low returns whereas if we look at the S&P 500 index for example which has seen an average annualized return of 10.75% with greater risk and fluctuation in returns.