IS YOUR BUSINESS READY FOR SALE?

IS YOUR BUSINESS READY FOR SALE?

A business might be sellable, but not ready for sale. Often businesses are put on the market when they are not ready. Either the business is listed for a price well below the real potential value of the business resulting in loss of huge amounts of unrealized value for the shareholders, or it is priced for its potential, but buyers generally will not pay a premium for potential, so the business sits unsold.

Declare all income as undeclared income is illegal and significantly reduces the overall benefit to the business owner.

EXAMPLE:

ABC Company is a manufacturing company located in Surrey, BC which has revenues of $2,000,000 annually with a normalized EBITDA of $200,000. The business sells through distributors in North America and Asia. The owner has customer in China who buys ABC’s product without its brand on it, adds their own brand and sells the product as their own in China. The customer makes 4 purchases annually and pays cash for each order in the magnitude of $100,000 per year. The owner of ABC Company puts the cash into a safety deposit box and pays for miscellaneous personal expenses with this money. The corporate tax rate is assumed to be 17%

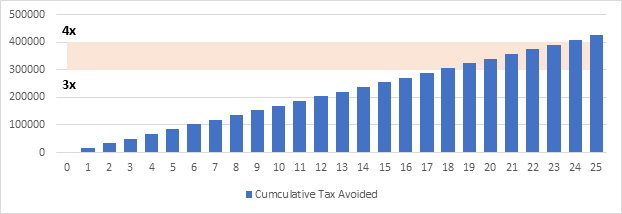

Figure 3: Effects of undeclared income on valuation

A typical manufacturing business may sell for between 3x to 4x EBITDA. Based on the normalized declared EBITDA a value of $600,000-$800,000 could be expected for this business. By not declaring the $100,000 annually the owner of ABC avoids approximately $17,000 (17%) in taxes and risks prison and/or fines if caught. Had he declared the income, the EBITDA would be $300,000 which would result in a valuation of between $900,000 to $1,200,000. With clean and transparent financial statement buyers would be open to a share sale which would allow the owner to crystalize their capital gains exemptions of $750,000 so they would only be paying capital gains tax on the surplus of $150,000 – $450,000. Buyers of company with any perceived contingent liability, especially with CRA liabilities would insist on an asset sale resulting in a significantly higher tax liability upon the sale of the business.

Not factoring in the potential tax liabilities upon sale of the business, in this example it would take between 18-24 years for a tax evasion strategy to equal the benefit for declaring all income as shown Figure 3. Any reputable business broker will refuse to sell a business in which a tax evasion strategy has been found.

Potential value of the business resulting in loss of huge amounts of unrealized value for the shareholders, or it is priced for its potential, but buyers generally will not pay a premium for potential, so the business sits unsold.

Owners of Small and Medium Enterprises (SME) generally run their businesses to minimize their tax obligations, and thereby maximizing their earnings and/or equity growth. It is not uncommon for business owners to expense certain personal expenses through the company. Mergers and Acquisitions specialist know this, and will spend time with the seller of a business to “normalize” the earnings. In other words they add back personal, and extraordinary and non-recurring expenses to show the “true” earning of the business.

During the due diligence phase of the sales process, any potential buyer will scrutinize these normalisation to determine if they feel that they are appropriate. It is imperative that any normalizations can be substantiated with appropriate documentation. Ensuring that there is a transparency in the financial records will go far when it comes to

What normalization cannot do is adjust for revenue. From time to time we see a business where the owner has been taking cash and not declaring it in their business. This in not only illegal, but seriously diminishes the value of the business. This is evidenced in the following example: